This year, Fintech Sandbox Demo Day will take place on April 28. The presentations will be virtual and the event, as always, is free. Demo Days are exciting because we get to showcase startups that are on the very cutting edge of innovation and you get to see what they’re up to before they’re discovered.

Over the next few weeks, we’ll highlight this year’s presenting entrepreneurs. Today, we’re talking to Helge Jørgensen, Co-founder and CEO of Norwegian fintech 7Analytics. 7Analytics develops highly precise predictive models for flood risk for insurers and asset owners.

Helge, tell us a bit about 7Analytics. What problems are you solving?

Floods are frequent and expensive. And this keeps growing. Without much better data people cannot insure their homes and businesses keep their operations going. We provide that data at a much greater granularity.

Why is granularity in flood prediction important and how do you achieve it?

Insurers need to understand flood risk in-depth – property by property. Water moves along the landscape and even a few inches of height difference here or a green spot there makes a huge difference for flood risk. Only the best data tells you the difference in risk from one side of the street to the other.

What is your company’s origin story?

Our founder team built their skills in the offshore oil and gas sector which remains one of the most knowledge intensive industries in one of the toughest environments on Earth. From here a drive to learn and apply the best possible data tool to produce the best possible solutions has led us to flood risk and to breaking away from traditional approaches.

Can you describe what it’s been like to be part of the Fintech Sandbox community?

7Analytics has moved in two dimensions recently and Fintech Sandbox has been an important partner in both consolidating our services to the financial industry and establishing our US organization.

Why is data access important to your startup?

Data is all we do. Much geodata is open source, but we have only made it this far by building partnerships with leading industry players around data access.

What milestones has 7Analytics achieved so far?

Being live on four continents is a major thing that I am super proud of – this includes my own relocation from Europe to Boston and setting up shop here.

What trends in fintech are you most excited about?

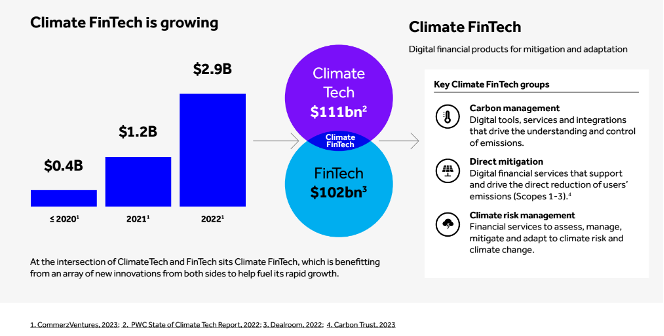

Climate innovation has for a long time been very focused on getting emissions down. For good reasons. Now, adaptation is growing in importance and this basically is a matter of risk. Climate risk. And here fintechs play a key part in getting the banks and insurers up to speed.

How does 7Analytics think about leveraging AI in a differentiated way?

AI and Machine Learning is driving a paradigm shift in water risk modelling. The focus is going in a direction of high-quality, rich input data and really understanding patterns and building predictive power. But: many – also insurers – remain anchored in traditional models.

What’s next for 7Analytics?

Kicking in doors to more insurance companies that are realizing that they need much better data to handle the increasing flood risk.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

To hear more about 7Analytics and 4 other exciting fintech startups, be sure to register for Fintech Sandbox Demo Day 11!